Electric Vehicle Mandates and Federal and State Incentives

November 29, 2022

Electric Vehicle Mandates and Federal and State Incentives

Electric Vehicle Mandates

In the fall of 2020, California Governor Gavin Newsom announced that California would allow new retail sales of only electric vehicles by 2035. This caused shockwaves at the time, but it was only the start. Several of the 14 states that follow California’s low- emissions vehicle (LEV) and zero-emissions vehicle

(ZEV) standards set by the California Air Resources Board (CARB) — states that choose to follow the stringent California emissions standards over the federal EPA standards — followed suit, along with a few non-CARB states.

In addition to California, many other states have declared a move to EV only. New Jersey aligned with California on setting 2035 as the year to transition to only electric-vehicle sales. States such as Rhode Island and Washington have gone even further, declaring their EV-only mandate will begin in 2030. Slowly but surely, it is expected that all states that follow California's emissions standards, as well as the states that plan to follow California’s emissions standards as of 2025, will do the same. Combined, these states make up 69% of EV registrations in the U.S. and 41% of total registrations.

While the United States and China are not among the 15 countries agreeing to go EV only by 2040 at the U.N. Climate Change Conference (COP26) in Glasgow, clearly there is a heavy movement shifting most of the U.S. retail market toward that end, as a large array of auto manufacturers have announced plans to shift to all or mostly electric in a similar time frame.

Federal and State Incentives

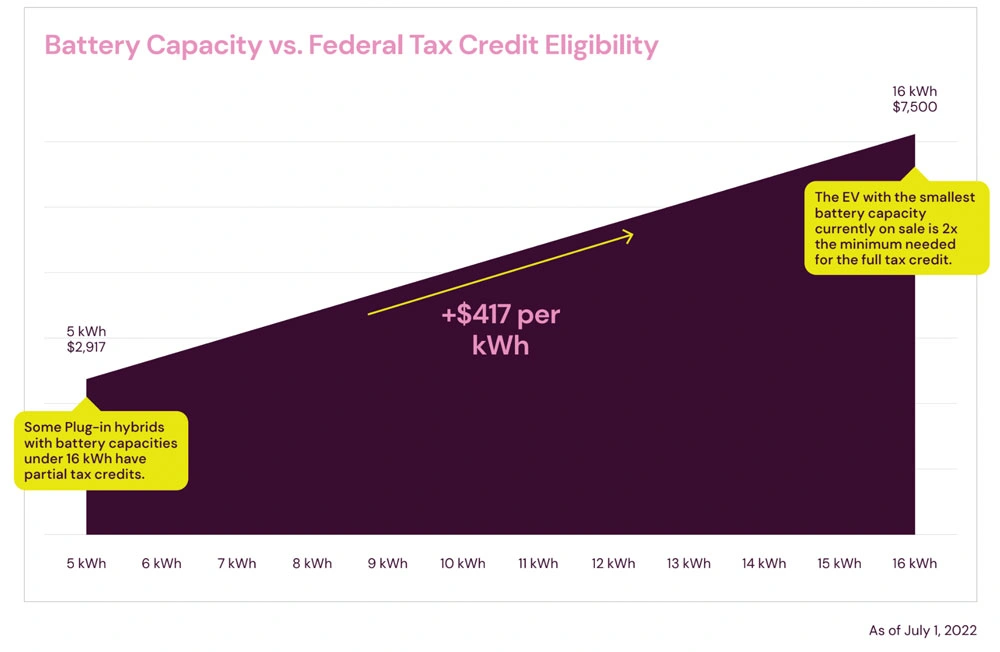

Ever since the Energy Improvement and Extension Act of 2008 first granted them, federal tax credits have been an integral element of the electric vehicle value proposition. The tax credit starts with the amount of $2,500 for any vehicle (plug-in hybrid electric vehicles — or PHEV — included) with a battery pack capable of more than 5 kWh of capacity, plus $417 for each kWh over 4 kWh, not to exceed $7,500 in total. For example, if a vehicle has a battery pack with a capacity of 9 kWh, it would be eligible for a tax credit calculated as such:

$2,500 + $417 x (9−4 kWh) = $4,585

Thus, any vehicle with more than 16 kWh of battery capacity would be eligible for the full $7,500 tax credit. The Mazda MX-30, which has a 32-kWh battery, is currently the vehicle with the lowest battery capacity on the market; therefore, every EV on the market has a battery capacity that would be eligible for the full federal tax credit. Even a number of PHEVs are eligible for the full tax credit.

Notably, the federal tax credit is just that: a tax credit, and not a discount at the time of purchase. Thus, the buyer of the vehicle would need to have sufficient tax liability to take advantage of the benefit. To have a tax liability of over $7,500, single filers would need to earn $54K; married couples, $66K; or heads of household, $61K, not including the benefit of tax deductions or other tax credits.

Note that these tax credits begin to phase out once the aggregate number of vehicles eligible for the federal tax credit sold by a manufacturer reaches 200,000. This phaseout takes one year and begins in the second quarter after the manufacturer hits the magic 200K number. In the following quarter, the tax credit eligibility drops to 50% (i.e., $3,750 instead of $7,500) for two quarters, and then down to 25% (i.e., $1,875 instead of $7,500) for another two quarters. After that point, the tax credit drops to $0. Tesla hit cumulative sales of 200K in Q3 2018 and began its one-year phaseout in Q1 2019. General Motors did the same one quarter later. Toyota is likely to reach the 200,000-vehicle mark by the end of Q2 2022, and thus will begin its one-year phaseout in Q4 2022. Ford and Nissan are the next two companies likely to reach the 200,000-unit mark. The effect of these federal tax credit phaseouts is that electric vehicles will only continue to become more expensive relative to a comparable gasoline-powered vehicle, even if the manufacturer introduces a price cut to offset some of the higher net cost.

In addition to the federal tax credit, a number of states offer additional incentives. California, where 42% of the nation’s EVs are registered, offers a $2,000 rebate through the Clean Vehicle Rebate Project (CVRP) for EV buyers with a gross annual income under $135K for single filers and $200K for joint filers. But even then, this program has a funding cap that has been reached in the past and has required the state legislature to issue further funding to enable the program to continue. Another program, the California Clean Fuel Reward (CCFR), grants buyers another $750 at the time of vehicle purchase rather than requiring them to apply for it after the sale. Both programs have seen their rebate amounts reduced as well as their eligibility criteria tightened in the past. It would not be inconceivable that these programs could be eliminated altogether. Select local municipalities and utility companies offer additional programs in the form of rebates or bill credits.

Other states with higher levels of EV registration volume have a patchwork of programs. Both Washington and New Jersey waive the sales tax for EVs. New Jersey has even combined that benefit with a rebate based on EV range that offers as much as $5,000 for vehicles with more than 200 miles of electric range. Some incentives include home charger installation rebates and more favorable “time of use” electricity rates for EV owners.

EV incentive programs are continuously changing at all levels — federal, state, and even municipal. In some cases, the programs are getting better; for example, Washington introduced a bill granting as much as $7,500 in state EV rebates. While that bill did not pass, it signals continued interest by the legislature to incentivize EV sales. Keep in mind that as EV adoption continues to increase, other states may follow California’s lead in reducing reward amounts and further restricting program eligibility, as budgetary pressures never cease to loom over such efforts.

Photo by Alexander Grey on Unsplash

•This article was excerpted from Autonomy’s Electric Vehicle Market Report, Issue 1. To download the full report for free, click here.