Electric Vehicle Marketing Report: Used-Vehicle Market Analysis and Forecast

December 13, 2022

Electric Vehicle Marketing Report: Used-Vehicle Market Analysis and Forecast

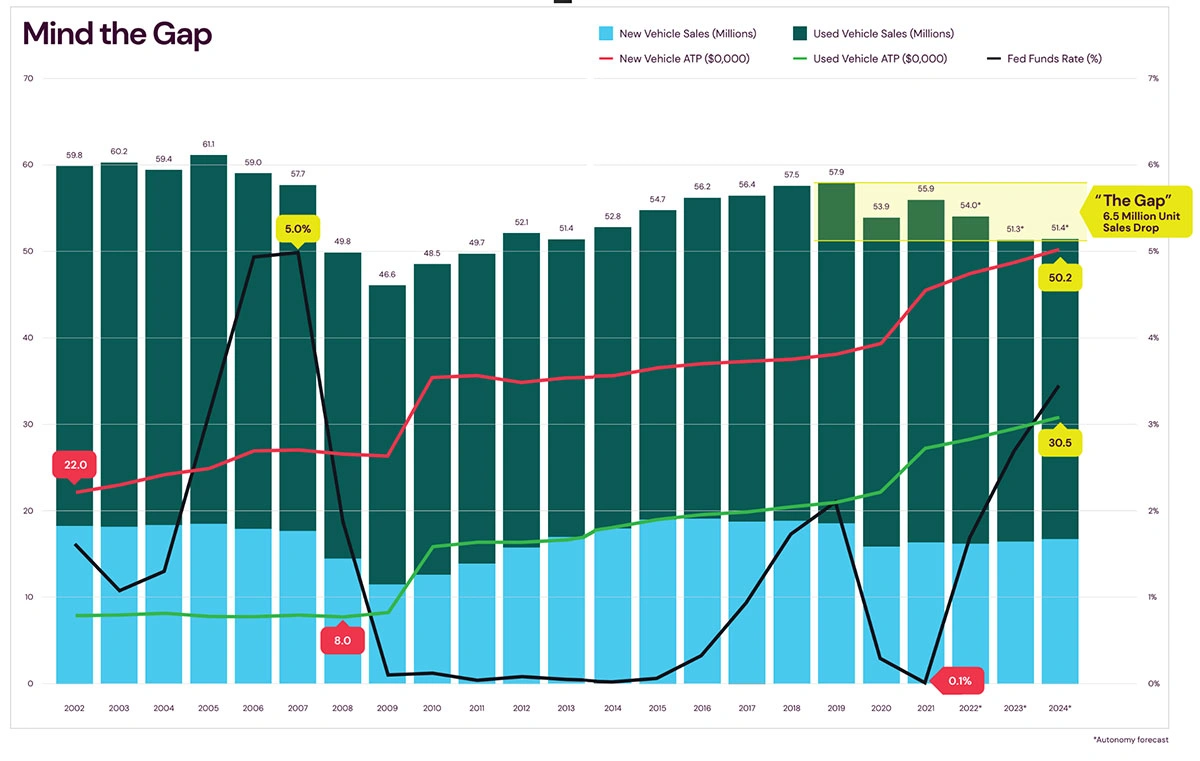

A perfect storm of record new- and used-vehicle average transaction prices (ATPs), record low inventory levels, very low number of future lease return units, climbing interest rates, and a sales gap of 6.5 million units compared to the pre-pandemic levels in 2019 will put unprecedented pressure on used-vehicle market prices for the foreseeable future. Vehicle affordability will drop beyond any current forecasts, necessitating alternative methods of access to vehicles to keep the country moving.

There are three main sources for supply of used cars:

1. Lease returns

2. Rental car and fleet sales

3. Consumer trade-ins, private sales

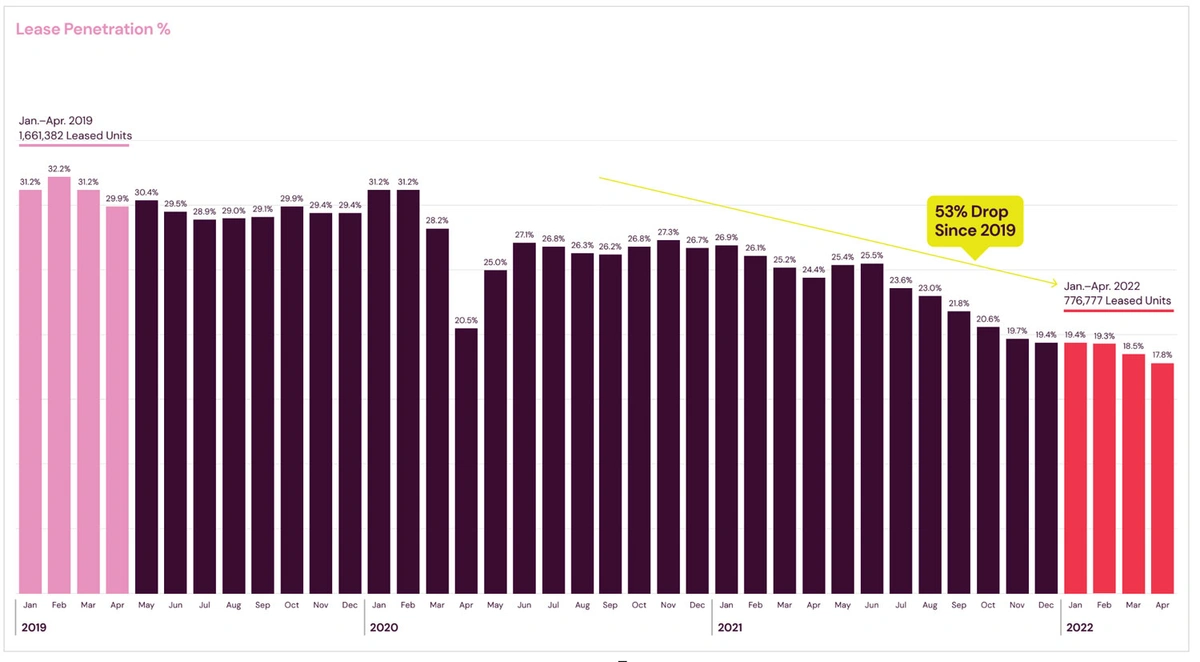

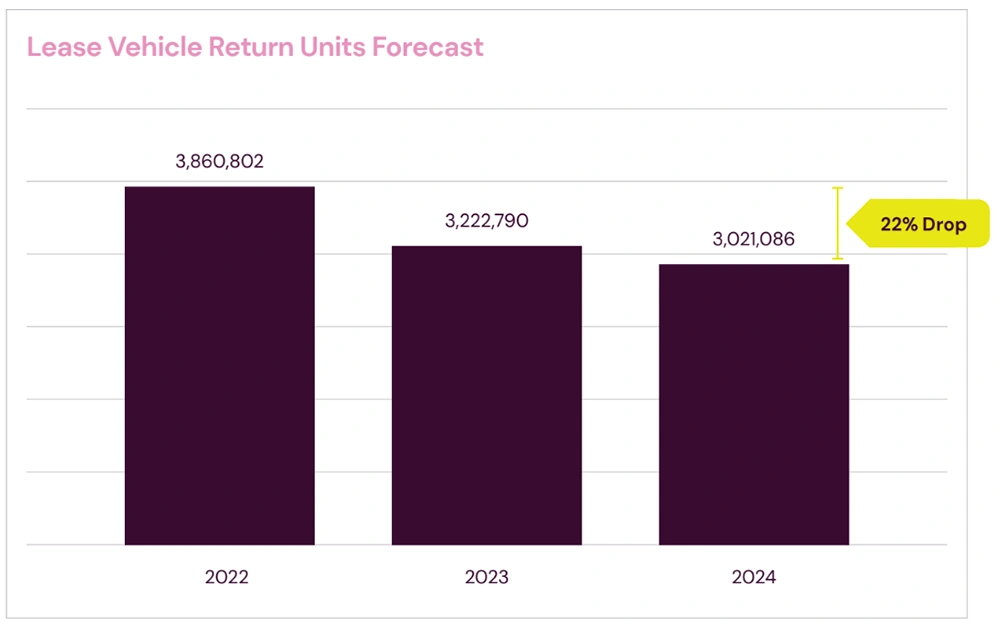

All three of these sources have experienced significant declines since Q1 2020 but lease returns, in particular, are about to experience an astonishing drop that most market predictors seem to have forgotten about: the most common lease term is 36 months. When we get to March 2023, vehicles that were leased back in March 2020 will be coming back to the remarketing channels. Extremely minimal numbers of cars were leased starting in March 2020 and many months following, which means one of the largest sources of supply of newer used cars will nearly completely dry up in the coming months, and only experience a modest recovery for the next three years after that, if not longer.

More than 5 million leased vehicles were returned in 2021.

When we take these millions of vehicles out of the already-tight supply, we can easily deduce that the record-high prices for used cars are not only here to stay, but also, used cars are about to get even more expensive for a sustained period — very likely, several years.

Image by senivpetro on Freepik

•This article was excerpted from Autonomy’s Electric Vehicle Market Report, Issue 1. To download the full report for free, click here.